Alternate Payment methods – How Africa is solving Digital Finance Exclusion.

THE LOGUE- An African –focused Fintech Newsletter | Vol 14 | March 13th 2023

Happy Monday Fintechies,

Welcome back to The LOGUE, a newsletter for professionals, investors, and enthusiasts who are interested in the African Fintech space. If this was forwarded to you, we’ll like you to become part of our growing tribe of subscribers by clicking below.

In honour of International Women's Day, we’ll focus our African fun facts on the amazons of the continent who have accomplished awesome feats. Look at a few facts:

In Africa, women have made significant strides in leadership positions in recent years. Rwanda has the highest percentage of women in parliament in the world, while the first female President in Africa was Slyvie Kiningi. She was the Prime Minister of Burundi from February 10, 1993, to October 7, 1994. During this period, she served as the acting President of the country for 5 months.

Next up is the news highlight for last week.

News Highlights

We are moving towards the end of Q1 2023, and activity in the Fintech Ecosystem is at an all-time high. We’ll start with a brief nod to the SVB news( we know you have been inundated by all the posts), but the question is - how does this affect the African Ecosystem? This is what we have gathered:

We know how a good number of African startups are registered as well as have funds in US banks.

Before Mercury Bank became popular, SVB was the go-to bank for startups.

And so, a number of African startups had deposits in SVB as collateral for cashflow loans etc.

YC’s Garry Tan tweeted - “30% of YC companies exposed through SVB can’t make payroll in the next 30 days.”

Things are still sketchy but companies like Chipper Cash have put out a formal statement.

Just in this morning!- Depositors will be protected, but shareholders and unsecured debts are in the cold.

Moving on from that, it is interesting to see the quality of partnerships happening on the continent. Whilst the public is still debating if Fintechs will kill Banks and whatnot, Diamond Trust Bank Kenya and Mastercard teamed up to do a thing!

They’ve partnered to provide the Issuing, processing, and settlement infrastructure that will fast-track the time Fintechs and Tech-enabled companies need to issue card products.

This partnership is ensconced in an exclusivity covering Kenya, Uganda, and Tanzania. It is coming at the right time DTB just received approval from the Central Bank of Kenya (CBK) to offer Cards-as-a-Service using their regulatory license to tech-enabled approved partners.

Another mega-partnership is the deal between Clickatell and South Africa’s largest integrated communications company, Telkom. Clickatell has launched its Chat 2 Pay feature for Telkom’s customers. Millions of customers can now make payments in WhatsApp, the country’s largest chat channel.

A number of Key hires were also announced across leading fintechs and banks in our region. See below.

Ecobank Transnational Incorporated (ETI), the Ecobank parent company, named Jeremy Awori as CEO of the Ecobank Group. Mr. Awori is a Banking veteran with over 25 years in the industry.

Moniepoint has appointed Pawel Swiatek as its new chief operating officer (COO). Swiatek was previously at Capital One, where he served as managing vice president for over four years.

Standard Chartered Bank Ghana PLC has appointed Ebenezer Twum Asante as Chairman of the Board of Directors with effect from March 1, 2023.

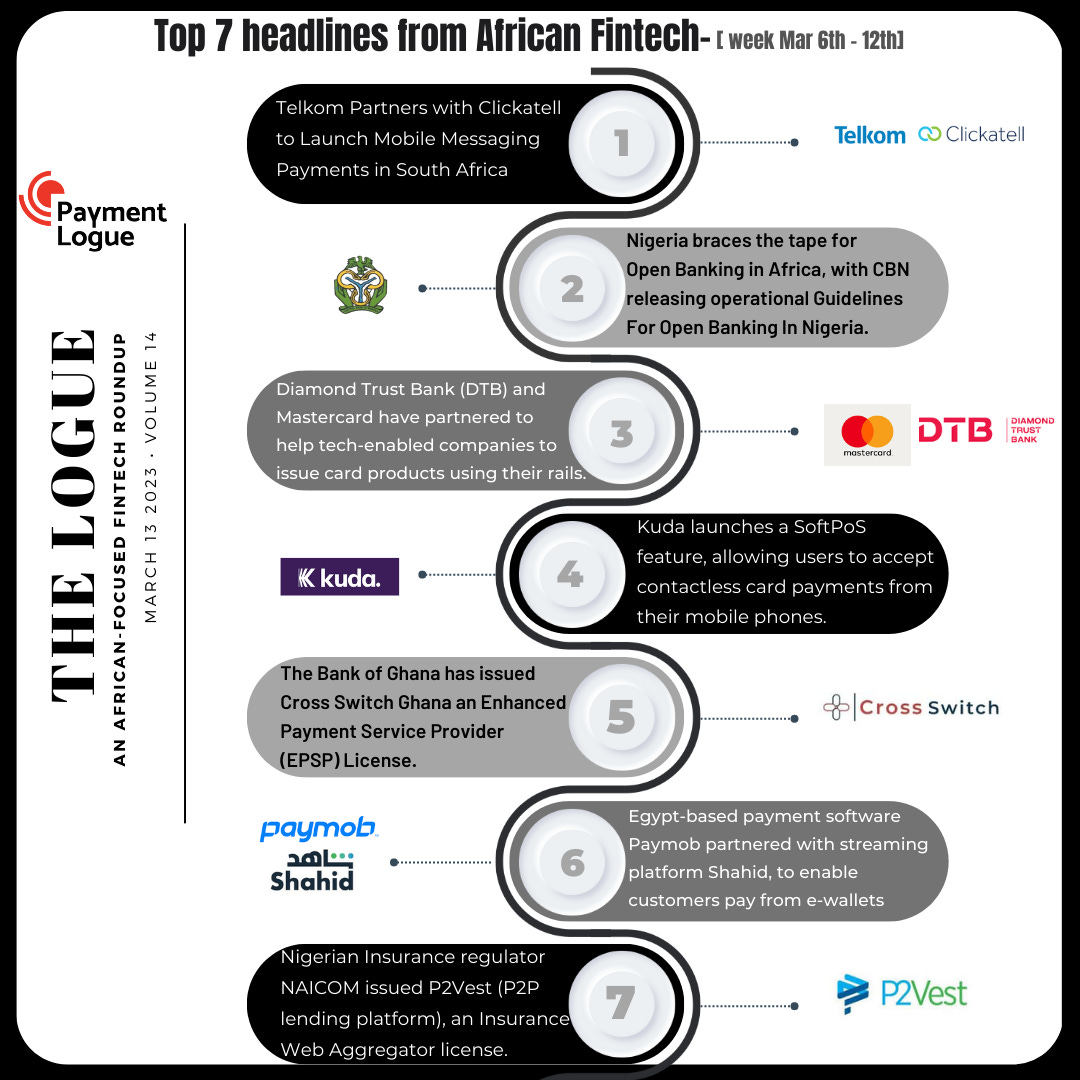

As usual here is a selection of 7 top headlines that made the news last week

Events and Community Information

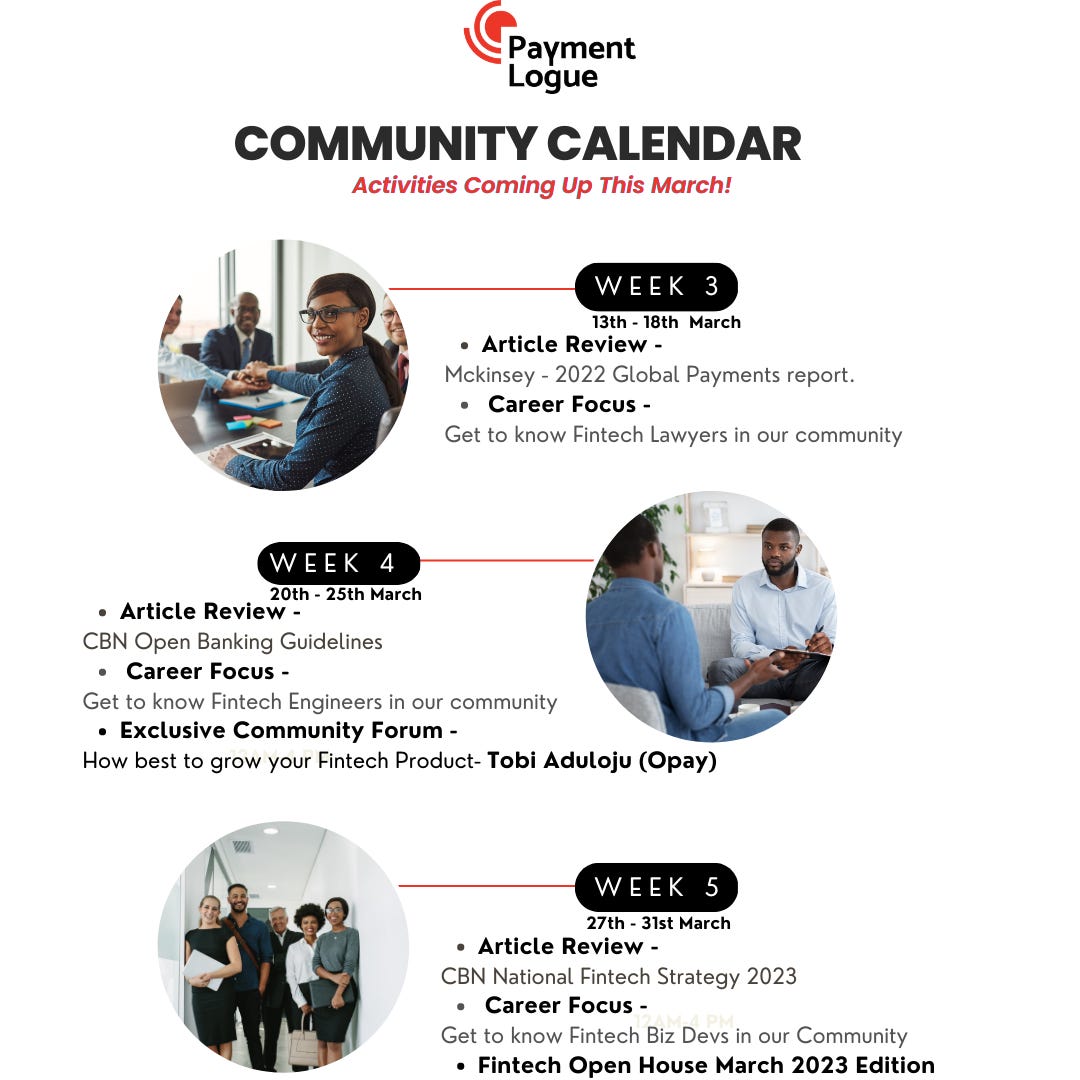

Looking for a place to network with other Fintech professionals working in the same space? Our community on slack provides knowledge, motivation, and inspiration from people of like minds.

If you work in the Fintech space, come join us! We have interesting channels, and our engagements are insightful and empowering. We are sure a few of our channels will pique your interest. See our session lineup for the month.

The Deep Dive - How Africa is solving Digital Finance Exclusion.

Payment Methods are preferred ways to make payments in a specific region or country. It is an intersection of how merchants prefer to collect money ( Acquiring) and how customers prefer to keep or move funds. These have evolved over time and in this article, we explore how most of Africa prefers to pay.

What are alternative Payment methods?

The most popular traditional payment method is Cash, but for digital finance, debit cards are very popular in Africa. Anything apart from cash and payment cards is considered an alternative payment method.

Interestingly, most are based on a payment card or a bank account. They are also referred to as APMs or local payment methods. These are the popular variants in Africa.

Mobile Money

Bank transfers

USSD Payments

Payment codes

Loyalty programs

Local cards

Delayed payment/BNPL

Payment Methods vs Payment Gateways

For brevity, a Payment Gateway would have one or more Payment Methods, so they can’t be the same thing. We have defined a payment method in the 1st section, so what is a Payment Gateway? It is an interface that connects the merchant to the processor and securely routes payment requests and responses. Payment gateways bring a difference to the payment methods they support by providing merchants and customers with a unique, superior experience.

Factors affecting the evolution of Payment methods per region.

The popular saying ‘Africa is not a country’ underscores the different behaviors and trends you’ll see per region and country. In this section, we’ll explore the mix of things that contribute to these differences.

Ease and Convenience: How easy is it to start using it and keep using it?

Fees: This is a major one as Africans are very sensitive to fees.

Perks and Freebies: Do you offer any perks for continued usage, loyalty points or discounts?

Tech Literacy level: Does it require knowledge of any complex technology? Then it’s out!

Consumer Behavior and trends: What are the practices and trends in that region , some providers have latched on to a trend like saving for relocation, for weddings or football season to create a sticky offering.

A Regional breakdown

The important thing to note is how these APMs differ per Country. In this section, we will take a look at five major Countries.

Kenya (Unique fact: High internet penetration)

M-Pesa is the dominant APM in Kenya. It is a mobile phone-based money transfer service, payments, and micro-financing service that provides transaction services through a SIM card. Once the SIM has been inserted into the card slot of the mobile device, users can make payments and transfer money to vendors and family members with SMS messages.

SA (Unique fact: largest percentage of banked)

In South Africa, Debit card payments remain the dominant payment method, with Visa having almost 50% of the market share. Bank transfers and Digital wallets are increasing rapidly. Merchant acceptance is made possible by large Fintechs like Yoco.

Crypto payments are also getting popular as Pick n Pay, one of South Africa’s leading retailers, reportedly now accepts bitcoin as payment at all its stores across the country

Egypt (Unique fact: Advanced E-commerce market)

In Egypt, Fawry has created a dominant alternate method to pay. Mobile wallets have witnessed a major increase in Egypt. Fawry launched its mobile payments app, myFawry, which offers bill payments including mobile recharge, mobile and internet bills, utilities, digital content subscriptions, and donations. myFawry is dominating e-wallets in the country with a market share of 60%.

Ghana (Unique fact: High MMO penetration)

Mobile Money Payments has risen from 2019 to become the most dominant APM. Providers like ZeePay, Express Cash, Tigo and others. The Bank of Ghana has a domestic card scheme as well as a CBDC, eCedi, but Mobile money payments are still preferred.

Nigeria (Unique fact: Most advanced Fintech market ( Funding + Number of Startups)

The Nigerian market is a tricky one to navigate as it is complex. Alternate payment methods are a lot and can be grouped into card-based and account-based methods.

Card-based payments seemed to be dominant in the past but statistics from NIBBS from the past 3 years show almost 50% growth on Mobile. The largest channels in the chart below are web and mobile and both speak to the data we discussed above.

Card-based APMS: Virtual Card, Payment codes and USSD Payments. All these are innovative but have a traditional payment card in the background.

Account-based APMS: Account Payments, Payment by Bank transfer and Digital wallets.

What next?

Africa maybe tackling the payment problems per Region, but a greater value to unlock is connecting the whole continent. This will make it easy for these bespoke payment methods to be extensible over the continent, unlocking more trade and value.

This excerpt from an article by Access bank quantifies the proposition better:

‘more than 80% of transactions sent from Africa to the US have their final beneficiary in other regions. The three main regions where these payments will eventually be transferred to are Asia Pacific (42%); Africa (I7% ) and Non-Euro Zone (10%)’.. and so ‘these payments had no business leaving the shores of Africa in the first place only to clear in the US and come back to Africa.’

This is the opportunity PAPSS is trying to unlock, but as we have seen with the UK, Europe and Asia, collaboration with private entities might provide a faster time to market.

Sponsorship & Partnerships

Do you want your Fintech Products and platforms to reach a growing audience of professionals and decision makers in the African Fintech Space? Contact us to feature your Product or for sponsoring an edition. Whatsapp Chat - 07025254596

Want to catch up on the latest news in the ecosystem, this is your spot. Check out our learning materials at The PaymentLogue.

At The PaymentLogue, we are enabling a skilled Fintech ecosystem. If you'd like to make enquiries on our courses and events, reach out to us at info@thepaymentlogue.com

Yet to subscribe to our news letter? Click on the button below to get our weekly news insights on the Fintech ecosystem.